Down Payment Assistance Programs in Evansville, IN: Your Guide to Homeownership

The dream of homeownership often feels out of reach when you're trying to save for a down payment while paying rent and managing everyday expenses. If you're a first-time home buyer in Evansville, Indiana, you're not alone in facing this challenge—but you have more options than you might think.

Evansville offers several down payment assistance programs designed specifically to help residents like you overcome the initial financial hurdle of buying a home. From local non-profits to federal programs, there are resources available that can provide grants, low-interest loans, or forgivable loans to cover your down payment and closing costs.

HOPE of Evansville: Your Local Partner in Homeownership

HOPE of Evansville (Housing Opportunities Providing Equity) is a non-profit organization that has been helping Evansville residents achieve homeownership for over 30 years. They're one of the most accessible resources for down payment assistance in the area.

What HOPE Offers

Down Payment Assistance Program

-

Provides up to $5,000 in down payment and closing cost assistance

-

Available as a forgivable loan that converts to a grant if you remain in the home for 5 years

-

No monthly payments required

-

Must be combined with a first mortgage from an approved lender

Indiana Housing & Community Development Authority (IHCDA) Next Home Program

The IHCDA Next Home Program is a powerful state-level down payment assistance program available to eligible homebuyers in Evansville and throughout Vanderburgh County. This program can provide substantial help with your down payment and closing costs, making homeownership significantly more accessible.

How Much Assistance Can You Get?

The Next Home Program offers:

-

Up to 6% of the loan amount for down payment and closing cost assistance

-

On a $150,000 home, that could be up to $9,000 in assistance

-

On a $200,000 home, that could be up to $12,000 in assistance

-

Available as a zero-interest, forgivable loan

Key Features and Benefits

Forgivable Loan Structure:

-

The assistance is provided as a second mortgage with 0% interest

-

No monthly payments required on the second mortgage

-

Loan is forgiven after 10 years of continuous homeownership

-

If you sell or refinance before 10 years, you'll need to repay a prorated amount

Flexible Loan Combinations:

-

Can be combined with FHA, VA, USDA, or conventional loans

-

Works with various first mortgage programs

-

Can potentially be stacked with other assistance programs (subject to guidelines)

Eligibility Requirements

To qualify for the IHCDA Next Home Program:

Income Requirements:

-

Household income must be at or below 80% of the area median income (AMI)

-

For Vanderburgh County, this is approximately $60,000-$65,000 for a family of four (varies annually)

-

Income limits vary by household size

Credit Requirements:

-

Minimum credit score of 640 (may vary by lender)

-

Clean credit history with no recent bankruptcies or foreclosures

-

Debt-to-income ratio requirements similar to your primary mortgage

Home Purchase Requirements:

-

Must be purchasing a primary residence in Indiana

-

Property must meet minimum property standards

-

Purchase price limits apply (generally up to $300,000-$350,000 depending on location)

-

First-time homebuyers get priority, but repeat buyers may qualify in certain circumstances

Education Requirements:

-

Must complete a HUD-approved homebuyer education course

-

Available online or in-person through approved providers

-

HOPE of Evansville offers these courses regularly

How to Apply

The Next Home Program is administered through participating lenders:

-

Find a Participating Lender - Not all lenders participate; ask your lender if they offer IHCDA programs

-

Complete Homebuyer Education - Take the required course before or during the application process

-

Apply for Primary Financing - You'll apply for your first mortgage and the Next Home assistance simultaneously

-

Meet with Your Lender - They'll determine your eligibility and assistance amount

-

Close on Your Home - The assistance funds are provided at closing

Real-World Example

Scenario: Sarah is buying a $180,000 home in Evansville using an FHA loan (3.5% down).

-

FHA requires 3.5% down: $6,300

-

Estimated closing costs: $5,000

-

Total cash needed: $11,300

With IHCDA Next Home (6% assistance):

-

IHCDA assistance: $10,800 (6% of $180,000)

-

Sarah's out-of-pocket: Only $500

-

Monthly payment on second mortgage: $0

After 10 years of homeownership, the $10,800 loan is completely forgiven!

Evansville Promise Zone Benefits: Enhanced Federal Program Access

Evansville is home to a federally designated Promise Zone, which means residents in certain neighborhoods have enhanced access to federal programs and resources. This designation brings additional opportunities for down payment assistance and homeownership support that aren't available in other areas.

What is the Evansville Promise Zone?

In 2014, the U.S. Department of Housing and Urban Development designated portions of Evansville as a Promise Zone. This 10-year designation (extended through 2024 and beyond) provides:

-

Priority access to certain federal grants and programs

-

Enhanced funding for community development initiatives

-

Targeted assistance for housing, education, and economic development

-

Special consideration for federal program applications

Geographic Coverage

The Evansville Promise Zone includes several neighborhoods:

-

Jacobsville

-

Jimtown

-

Goosetown

-

Riverside

-

Downtown core areas

-

Portions of the near west side

Check with HOPE of Evansville or the City's Community Development office to confirm if a specific property is within the Promise Zone boundaries.

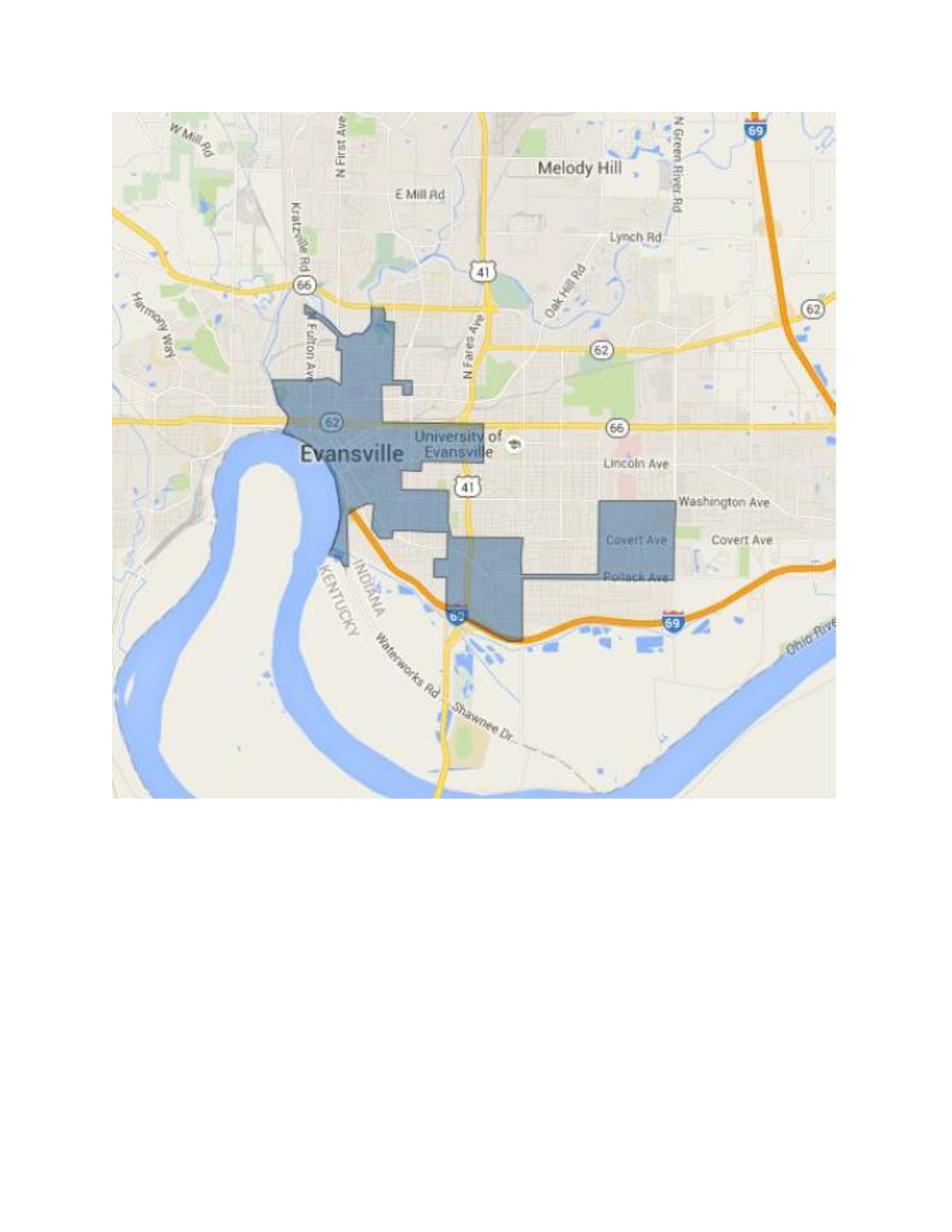

Evansville Promise Zone Map

Map shows the boundaries of the Evansville Promise Zone. Properties within the shaded areas may be eligible for enhanced federal program access and additional assistance. Download full PDF map

Housing Benefits Within the Promise Zone

Enhanced Down Payment Assistance:

-

Priority consideration for federal HOME Investment Partnership funds

-

Access to additional Community Development Block Grant (CDBG) resources

-

Potential for higher assistance amounts in designated areas

Rehabilitation and Repair Programs:

-

Grants for home repairs and improvements

-

Lead paint abatement assistance

-

Energy efficiency upgrade programs

-

Emergency repair funds for qualifying homeowners

Community Development Initiatives:

-

Neighborhood revitalization projects that increase property values

-

Infrastructure improvements (streets, sidewalks, lighting)

-

New park and recreation facilities

-

Small business development support

How Promise Zone Status Helps Homebuyers

1. Increased Program Funding

Federal agencies give preference to Promise Zone projects, which means more money flows to housing assistance programs in these areas. This can result in:

-

More funds available for down payment assistance

-

Shorter waiting lists for assistance programs

-

Additional program options not available elsewhere

2. Community Investment = Rising Values

The Promise Zone designation brings millions in federal investments to these neighborhoods:

-

New businesses and job creation

-

Improved schools and community facilities

-

Better infrastructure and public spaces

-

All of which can lead to increasing property values over time

3. Coordinated Services

Promise Zone organizations work together to provide:

-

Simplified application processes

-

One-stop shopping for assistance programs

-

Case management and ongoing support

-

Financial counseling and homeownership education

Combining Promise Zone Benefits with Other Programs

If you're buying in the Promise Zone, you can potentially combine multiple assistance sources:

-

HOPE of Evansville assistance (up to $5,000)

-

IHCDA Next Home Program (up to 6% of loan amount)

-

Promise Zone-specific grants (amounts vary)

-

FHA or other low down payment mortgages (as low as 3.5% down)

Example: On a $150,000 home in the Promise Zone:

-

FHA loan requiring 3.5% down: $5,250

-

IHCDA Next Home (6%): $9,000

-

HOPE assistance: $5,000

-

Total assistance: $14,000

-

More than enough to cover down payment and closing costs!

Note: Not all programs can be combined. Your lender will help determine the best combination for your situation.

How to Access Promise Zone Benefits

-

Verify Property Location

-

Contact HOPE of Evansville at (812) 423-2382

-

Visit the City of Evansville Community Development office

-

Ask your real estate agent to check the address

-

Work with Local Organizations

-

HOPE of Evansville coordinates many Promise Zone housing programs

-

The Evansville Promise Zone office can provide information on all available resources

-

Apply Early

-

Some Promise Zone programs have limited funding

-

Start your application process 60-90 days before you plan to buy

For complete details on eligibility requirements, application process, and combining programs, visit the full article.

Key Programs Available

-

HOPE of Evansville - Up to $5,000 in forgivable loans

-

IHCDA Next Home Program - Up to 6% of loan amount for down payment

-

Promise Zone Benefits - Enhanced access to federal programs

-

FHA Loans - As low as 3.5% down payment

-

VA Loans - $0 down for veterans

-

Gift Funds - 100% of down payment can be gifted

Strategic Program Combinations

Understanding how to combine assistance programs can maximize your benefits:

Combination 1: Maximum Assistance

-

IHCDA Next Home: $9,000 (on $150K home)

-

HOPE of Evansville: $5,000

-

FHA 3.5% down: $5,250

-

Your required cash: May only need 1-2% of purchase price

Combination 2: Promise Zone Buyer

-

IHCDA Next Home: $10,800 (on $180K home)

-

Promise Zone grants: $2,000-$5,000 (varies)

-

Total assistance: $12,800-$15,800

-

Could buy with minimal out-of-pocket expense

Combination 3: Veteran in Evansville

-

VA Loan: $0 down required

-

HOPE assistance: $5,000 for closing costs

-

Could potentially buy with little to no money down